If You’re Going To Invest, Think First

Glenn Koach, president of hedge fund Concise Capital, and 2GreenEnergy’s financial advisor, once told me, “I’ve never known anyone who made money in precious metals,” which he immediately corrected: “Actually, I’ve never known any smart person who made money in precious metals,” implying the obvious: there are always going to be fools who get lucky and buy at precisely the right time.

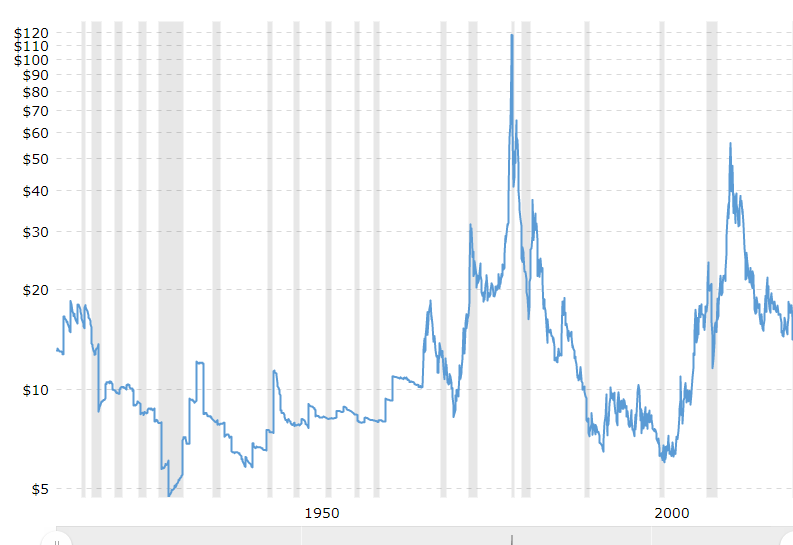

I had to laugh when I saw this thing about silver. In the late 1970s, when I was an impoverished graduate student, there were rare moments that I had two nickels to rub together, and would buy a five-ounce bar of silver for, as I recall, about $5 per ounce, which, inflation-adjusted, is today $19. So here we are, 41 years later, and a $19 bar is now worth…..$19. Had I held onto my ingots (which I didn’t) I would have made exactly 0%, and had eaten the opportunity cost of that money for over four decades.

If you’re thinking about an investment, look into cleantech, destined to be remembered as the defining industry of the 21st Century.

In 2013, 2GreenEnergy supporter Dr. Tom Konrad recommended that I buy Hannon Armstrong (HASI), provider of climate change solutions, which I did, at $5.03. It’s trading this morning at $33.63, that’s an AGR of 31.2%.