Andrew, very smart fellow, writes:

So Craig, it sounds like you are starting to believe that the “big” corporations (at least some of the automotive OEMS and utilities) are not actually devils. If that is correct — welcome to the real world. Now we need to work on your double-standard of calling the profit motivated green movement “good” while calling the profit motivated energy companies “bad.” …..

It seems to me that there is a clear distinction between entrepreneurship and our version of capitalism. We all see the inevitable conflict between the pioneering and independent spirit of entrepreneur, and the entrenched monopolies that normally develop as the end-point result of capitalism, that make every effort to pocket, crush or sabotage the most potentially competitive entrepreneurs by any means at their disposal — and generally triumph. Examples like Nikolai Tesla’s DC power, Henry Ford’s original ethanol engines, the Tucker automobile, the Red Car trolleys of Los Angeles, and the metal hydride battery — show the harm that dominant power structures will do to creative thinking, but will dine richly on slave labor, child labor, concentration camp labor, prison labor and sweatshops. Meanwhile, we have to live with their rampant waste and pollution of ecological resources, unsafe and inefficient vehicles, clinically worthless medicines (to the exclusion of curative research), and harmful food-like products that simultaneously fatten and starve.

Having said all this, I’m wondering if there isn’t some real change afoot. In particular, I’m very impressed with the sincerity I see in a great number of corporations in their embrace of sustainability efforts. I’m hoping that the ubiquity of information online has led us to a world where evil deeds are just too visible — and thus not worth the risk — where CEOs who lie go to prison (under SOX), etc.

It’s an interesting time to be alive — and watch different vectors: man’s basic goodness, greed, shame, and laws attempting to restrict corporate behavior — all hammering into one another.

Thanks for writing, Andrew.

Guest blogger Garth notes:

Guest blogger Garth notes:

I’m trying to learn about biomimicry, learning from and then emulating natural forms, processes, and ecosystems to create more sustainable and healthier human technologies and designs. And this learning process just led me to one of the most profound experiences of my life; I hope it means as much to you. Please check this out

I’m trying to learn about biomimicry, learning from and then emulating natural forms, processes, and ecosystems to create more sustainable and healthier human technologies and designs. And this learning process just led me to one of the most profound experiences of my life; I hope it means as much to you. Please check this out

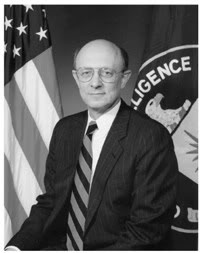

James Woolsey wrote an interesting opinion piece in the Wall Street Journal this morning. Mr. Woolsey is a former director of the CIA, has served in four administrations, is a foreign policy expert and Rhodes Scholar. He is also dedicated to renewable energy and energy security – in short, moving away from dependence on fossil fuels. Woolsey is a venture partner with VantagePoint, chairs the Strategic Advisory Group of Paladin Capital Group and is Counsel at Goodwin Proctor specializing in alternative energy and security. There are numerous posts on this blog on Woolsey – so readers have no shortage of material on the man.

James Woolsey wrote an interesting opinion piece in the Wall Street Journal this morning. Mr. Woolsey is a former director of the CIA, has served in four administrations, is a foreign policy expert and Rhodes Scholar. He is also dedicated to renewable energy and energy security – in short, moving away from dependence on fossil fuels. Woolsey is a venture partner with VantagePoint, chairs the Strategic Advisory Group of Paladin Capital Group and is Counsel at Goodwin Proctor specializing in alternative energy and security. There are numerous posts on this blog on Woolsey – so readers have no shortage of material on the man.