Morgan Stanley Likes the Energy Storage Market

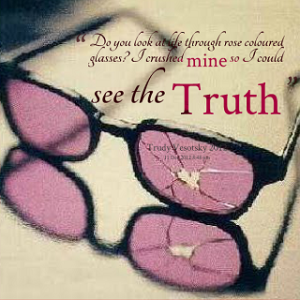

On the other hand, you have the truth. Here’s what Morgan Stanley has to say about the storage market, referring to it as the “next big power play.”

But would a company like that really know what “big” is? Let’s take a peek at the numbers. Their 55,000 employees manage $1.3 trillion for clients including corporations, governments, institutions and individuals from offices in more than 42 countries around the globe. I think we have to give them the benefit of the doubt on that one.

Craig,

I notice you have a tendency to embrace awkward bedfellows !

You seem to reserve admiration on the basis of self interest. Any person or organization who displays support for a cause you support receives your praise. It doesn’t seem to matter if the person or organization indulges in other practices or acts you normally loudly condemn, in those matters you just ignore as long as they support your crusade.

Morgan Stanley is a very old and substantial organization, but so was the equally large Lehman Brothers.

Like Goldman Sachs, Morgan Stanley and every investment bank are attracted to investments with government incentives and guarantees.

Energy storage can be an excellent investment since potential risks are sheltered by government guarantees and mandated consumer rates.

This isn’t to say the investments don’t have merit, but it’s fair to describe the investments as following government incentives rather than a ‘epiphany’ moment in green consciousness !

Each year for at least the last 15 years, Morgan Stanley pays $ millions, even $ billions, in fines for various breeches of law.

Everything from deliberate over-billing,improperly executing fictitious sales in Eurodollar and Treasury Note futures contracts, Tax frauds, price fixing, scamming investors and currency violations. Oh, and let’s not forget collusion with the PRC government and US legislators to in the ‘green energy market”.

Now, to me these are just the risks and dubious practices than can be expected from huge organizations who often find it cheaper to settle than fight.

But for someone like you, a person with such an unrelenting “moral compass” it seems you have an hypocritical willingness to compromise your moral outrage when convenient.