[The Vector] Renewable Energy News from Washington: Bipartisan Policy Center and New Energy Project

![[The Vector] Renewable Energy News from Washington: Bipartisan Policy Center and New Energy Project](https://www.2greenenergy.com/wp-content/uploads/2011/04/senator-trent-lott.jpg)

In light of the vitriol and partisan game-playing in Washington that seems to stall decision making, perhaps a bipartisan group can make an impact on the energy discussion?

A think-tank established by former Senate Majority Leaders Howard Baker, Tom Daschle, Bob Dole and George Mitchell, the Bipartisan Policy Center (BPC), aims to do just that. It was formed to develop and promote solutions that can attract public support and political momentum for real progress. It engages top political figures, advocates, academics and business leaders in the art of principled compromise.

BPC already has a number of projects and initiatives under way, including the Economic Policy Project, National Security Initiative, National Security Preparedness Group, Nutrition Initiative, and the Debt Reduction Task Force.

Now, the Energy Security Project is being formed. Senators Trent Lott (R-MS) and Byron Dorgan (D-ND) along with former National Security Advisor General Jim Jones and National Oil Spill Commission co-Chair William K. Reilly are heading the new project. The formal launch is scheduled for Tuesday April 12th in Washington DC. At the launch, Daniel Yergin will moderate a discussion among the four leaders regarding energy security.

Daniel Yergin is President of CERA (Cambridge Energy Research Associates) and Pulitzer Prize winner for his book, “The Prize: the Epic Quest for Oil, Money & Power.” The Vector will be following this new group.

A different group at BPC recently wrote a paper regarding renewable energy subsidies. A link to the report is found at the end of this article. The report states that “current tax policies are inadequate to support the achievement of ambitious renewable energy goals.” It points out two major challenges for renewable energy:

- The stop-start cycle of investment attributable to repeated short-term extensions and expirations of tax credit programs (i.e. no commitment or long-term plan), and

- The structural challenge of these tax-based incentives (i.e. a limited investor pool with limited liquidity which creates higher financing costs.)

“By failing to encourage steady, long-term investments, U.S. policies have not fostered stable industry growth…Domestic manufacturers have not captured all possible reductions in technology costs, thereby undermining the long-term competitiveness of renewable energy options,” says the report.

The report concludes that there is more than ample opportunity to improve effectiveness of current renewable energy policies.

The U.S. tax code limits renewable energy investors (while favoring fossil fuels) and creates barriers. In Europe, for example, more than 140 project financiers actively invest in clean energy where the investment is not limited to participants with specialized expertise.

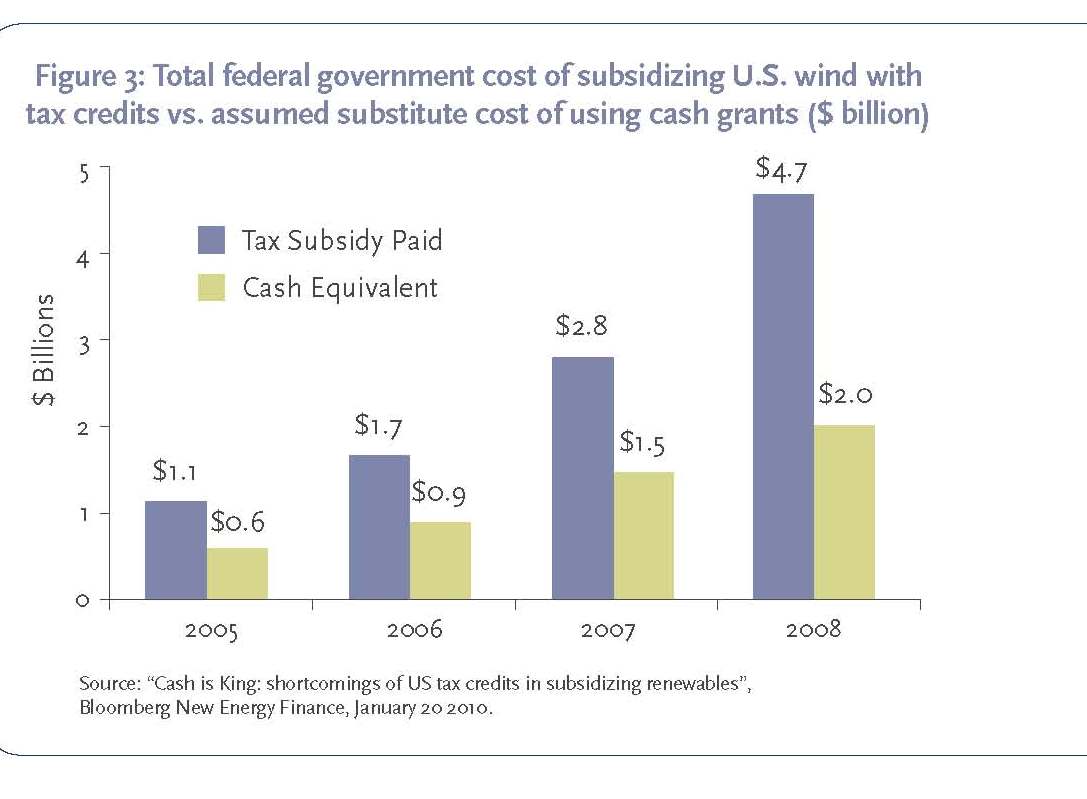

To illustrate one of their points, the study includes a focus on wind energy. The chart (shown below courtesy of BPC) lays out total federal government cost of subsidizing U.S. wind with tax credits vs. assumed substitute of using cash grants showing that tax credits can bring more investment and attract more financiers.

Three recommendations from the study are:

1) The policy framework for renewable energy must be predictable, transparent, stable and long-term.

2) Incentives should be adequate to enable renewables to compete against conventional energy sources but structured to provide incentives for continued technology improvement with cost declines over time.

3) Policies should serve to tap a variety of capital – a wider investment pool creates a more liquid market with lower financing costs.

The full report is available here at the Bipartisan Policy Center.

![[The Vector] Renewable Energy News from Washington: Bipartisan Policy Center and New Energy Project](/wp-content/uploads/2011/04/senator-trent-lott.jpg)