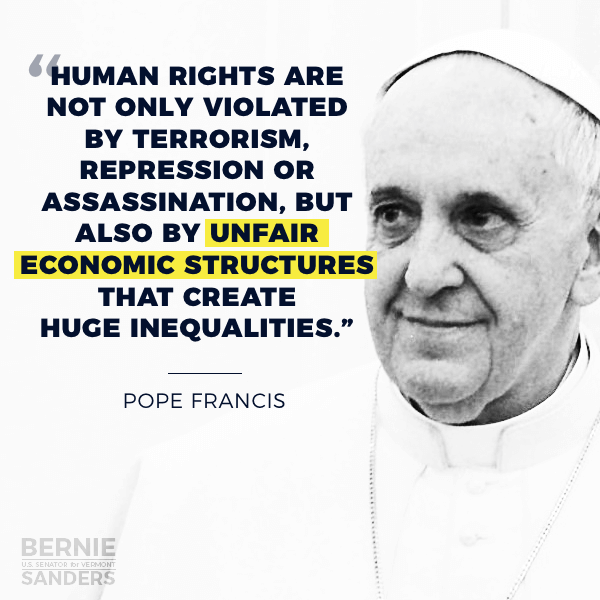

Pope Francis Calls ‘Em Like He Sees ‘Em

Where this is going is hard to say, but it can’t be good for anyone but the super-rich. Extrapolating from the last few decades, one can imagine a dystopian future in which the environment lies in ruins, shortages of food and potable water are everywhere, and the vast majority of the world’s people are so desperate that they’ve become ungovernable; everyone is suffering except for those who can afford to protect themselves from the chaos.

Here’s someone who’s “not havin’ it.” His name is Pope Francis.

Craig,

With the greatest respect to the Pontiff, he doesn’t have a degree in economics.

Not that it’s important. Most of the people who control the world economy are not educated in economics. When it comes to economic theory everyone is entitled to an opinion, because everyone has a stake in the economy. That’s why in most nations with elected representative government, the voters decide the nations economic policy through their elected representatives.

The curse of the 18th, 19th, and 20th centuries was the struggle to control economic dynamics. The economics of human civilization have always been a conflict between two basic human aspirations. Humans are outgoing adventurous, curious, acquisitive, ambitious, creative, competitive creatures, but also altruistic while seeking security and certainty.

These two aspects of human nature are in constant conflict.

Attempting to apply simplistic values to modern economics isn’t helpful. Nor is selective morality.

It’s easy to rant on about ” how the rich and powerful” are greedy despoilers and if only they were removed everyone would share in a new Nirvana with a cornucopia of plenty, where all would share equally in the bounty.

From time to time, this political ideology has been tried. The consequences of imposing such doctrines always result in chaotic bloodshed and immense economic damage followed by brutal repression, economic and environmental devastation and social misery.

Yet curiously, no matter how many times this sort of social experiment fails, there are always some who excuse the failures and try to pretend it would have been successful if only it had been given a “proper” chance !

Why ? Why do otherwise intelligent people find themselves defending the indefensible ?

The answer can be found in the second aspect of the human psyche. The need for stability, security and certainty. There’s also a degree of envy and resentment against those luckier, smarter or more talented.

Simplistic moral values may be valid in the conduct of individual lives, but is unhelpful when seeking to understand economic dynamics.

Modern economies are hugely complex. In recent times questions of what constitutes “wealth” have become difficult to define. Applying 17th century definitions to modern economics is pointless.

Huffing and puffing about “tax cuts” for the rich isn’t productive in a modern internationalized economy. The economy must continue to expand and consumer consumption must continue to expand or everyone will suddenly become poor.

Since humans first started living in permanent societies where surpluses of basic necessities could be produced, (civilization) the nature of wealth changed from being measured by having enough to eat and shelter, to the ownership of aesthetic goods produced by human creativity.

Wealth and consumption are no longer, and never were, always restricted to tangible consumer goods.

That remains the definition of “wealth” in modern economics. All modern economies are based on a “perception” of wealth rather than wealth itself.

I’m reminded of a dinner party I attended in the UK where at the table sat a couple who sagely observed they wanted a republic because if all the “rich” people were abolished the Queen would be forced to sell her Crown Jewels and feed the poor and homeless.

Now such a comment might be forgiven in the uneducated, but from a journalist for the Guardian newspaper, and a lecturer in Sociology and a tertiary institution, it becomes irritating.

I know both understood the lack of logic in their observation, but didn’t care. These two committed socialist-left acolytes had repeated this dogma so many times over the years, among their fellow travelers etc, that the lie had become reality. (The Crown Jewels are not the property of the Queen, they belong to the State, and with no ‘rich’ people anymore, who would buy the jewels !).

Wealth is no longer tangible. The notion of wealth is incredibly complex and constantly changing.

The people who marched in the “Occupy Wall Street” demonstrations, had no clear objective, no practical betterment, just self-deluded troublemakers finding an excuse to cover their own inadequacies.

Lowering the corporate and individual tax rate is a measure required in a competitive world to stay competitive. Hiking the tax rate hurts not the rich, but the poor who suddenly discover the joys of unemployment.

Modern societies provide a social “safety net” not to be nice or moral, but to avoid the social and economic consequences of having part of the population not participating in the economy.

The bewildering speed of information technology has transformed economics, leaving those in the rural and old economy behind. Those in the new economy are largely disconnected from older, more traditional local communities. These people live in a different world, almost a different dimension ! A good example is the enormous “wealth” suddenly created by “crypto-currencies”.

Over the last 18 months more than a $ trillion dollars has been created, speculated, lost and gained on this phenomena. My youngest son has astutely played this new source of “wealth” on it’s wild ride, and although I’ve been far more conservative, I personally and my investors have reaped truly gigantic profits.

The profits gained are even more Kafkaesque when you consider we don’t actually invest real money, but pay instead a fractional interest rate to issue instruments of guarantee, to buy and sell currencies that don’t really exist. To the ordinary man in the street, this must seem like fantasy dimension, and he’s right !

We just conducted an ICO for a client who created a small crypto-currency of 21 million tokens a 50 cents per token. The ICO was oversubscribed as result trading has been brisk and the tokens are now valued at just under $4 ! (a gain of 800%). The coins have no asset backing, no trading history, but $ 80 million dollars has just been added to the economy !

Crypto-currencies don’t exist in the physical world. Like derivatives and many other financial instruments they exist in a nether world of perception.

For governments, imposing and gathering taxing from these new ‘etheric’ industries existing in the ethernet, is nigh impossible.

Vast new industries have been created, like data mining. Data mining may be a larger industry in financial terms than actual mining ! Yet while you rail against the Koch bros, you have no concept of those becoming rich in this more nebulous and secretive industry.

For governments, imposing and gathering taxing from these new ‘etheric’ industries existing in the ethernet, is nigh impossible.

Craig, there’s no “cartel of extremely wealthy people using power to manipulate the law-making process”. What you are up against is the bewildering changes in the nature of wealth, and the struggle for governments to gather tax on increasingly nebulous definitions of wealth.

I have a young client who developed an app at exactly the right time and was paid a vast sum, more than the average individual could earn in 10,000 years ! Prior to the sale an accountant wisely valued the app at it’s true value of a few dollars and sold the asset to a company with a low tax regime, duly paying tax in the UK.

When the app was sold, payment came from a company in a tax haven partly in cash but also in shares and bonds. These tax arrangements were legal and properly disclosed.

The client happily disclosed these arrangements to be used by an MP campaigning for UK tax reform. (I’m not disclosing anything that’s not already in the public domain).

None of this obviates the needs for reform of the safety net. However, expanding the safety at the expense of economic reform is illogical. Citizens need opportunity, not welfare. Creating an ever expanding social welfare industry, is not only economic suicide but cruel.

Employing more sociology students in the welfare system to advise people how to cope being unemployed is no substitute for creating a meaningful job! The object of moving people off welfare and dependence to meaningful employment and independence isn’t just good economics but a moral duty.

The public sector can only create so many jobs, often in very negative services. Only the private sector can creatively expand to produce new employment. The private sector needs risk capital to expand, the sort of capital generated by lowering taxes on corporations and high income individuals.

The higher the rate of employment, the greater the governments tax base.