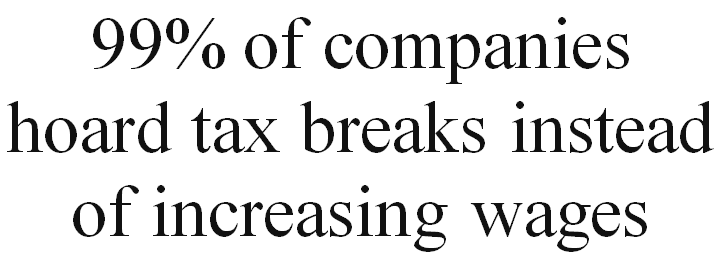

Here’s Where Corporate Tax Breaks Wind Up

I’m a kind and honest guy, and at one point I had about 110 employees. I took good care of them with generous benefits, Christmas bonuses and the like, but when I experienced a windfall profit, it went directly into my stock portfolio.

It never crossed my mind to share it with my employees, because I was the one who had signed up for this profile of risk/reward. I was the one with the multi-million dollar annual payroll to make; I was the one who could lose his house and the entirety of his net worth if things went south.

I hired new people, only to accommodate growth, and I gave raises when I thought it was the right thing to do, but it had absolutely zero relationship with profit that (occasionally) came out of the sky.

Craig,

All businesses really have three stakeholders.

1) Risk capital

2) Risk labour

3 Tax

Each provide and important function, and each must invest to make the business survive. If the risk capital investment becomes too poor or greedy, and neglects investing in labour and infrastructure, the business will ultimately lose its ability to compete and profits will decline.

Likewise, if labour becomes too greedy, unrealistic or unproductive, the business will suffer and become unable to compete and lose employees.

Tax is essential for any business, since government provide a safe and stable environment for businesses to invest securely. If the tax regime is too onerous, business will decline or move to more profitable climes.

Getting the balance right, is the basis of success for all the stakeholders.

I don’t blame you. You need to keep extra money in case profit goes down and you have trouble paying off your employees. That way you’ll at least be able to pay your employees for a couple of months while profits stabilize again.