Despite Nay-sayers’ Claims, Renewable Energy Is a Huge Industry

But it’s just absurd to claim solar /wind are viable sources of power for industrial societies. Power distribution networks are not designed to cope with intermittent power generation. (Nor can they be), Most renewable power is simply “dumped”. Nor can society be re-organized to function on solely renewable energy. It just won’t happen.

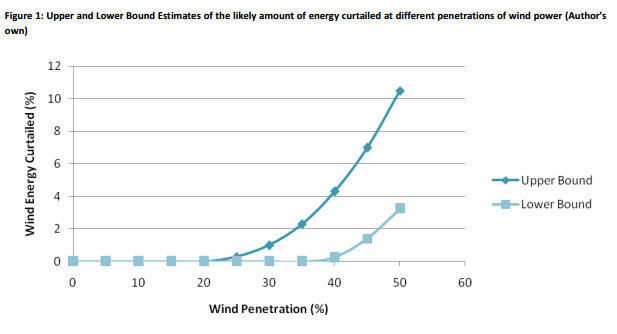

In the first place, very little power from solar and wind is “dumped.” As shown below, curtailment isn’t a huge issue (though it’s non-negligible) at low penetration rates (we’re at about 5% today). In the U.S., the curtailment rate is typically a couple of percent, though it can reach 10% in certain regions under specific and rare conditions. This is discussed at great length here, here, and here. From the last of the three:

The best wind sites have about a 40 percent capacity factor, meaning they produce an average of 40 megawatts per 100 megawatts of nameplate capacity over “all the hours of a year.” “If you’re losing — curtailing — two percent of that generation,” Moland said, “it really has a big impact.” Capacity factor is reduced to 38 percent, perhaps five percent of a wind farm’s production.

Here’s a chart supporting this from another article concerning curtailment in the UK:

The key thing to keep in mind is that the fact that these resources are variable does not mean they are worthless, which is precisely why this is a multi-trillion dollar industry whose growth rate has attracted an enormous amout of investment from institutional players. Just Google “renewable energy (name of bank).” Try the huge investment banks like Goldman Sachs, Credit Suisse, and Deutsche Bank, then a few retail banks like Wells Fargo. I’ve even done the work for you; these links go directly to articles detailing the nature and size of the bet their placing on renewables. You’ll see that most of them have entire business practices in this space.

These are the people I meet at the conferences I attend, btw; they’re not imaginary, they’re not investing fake money, and they have no reason to lie. As one fellow from a huge IB told me over lunch at the Low Carbon Investors conference, “we’re there because that’s where the money is.”

Note the title of the article linked above: “Credit Suisse Projects ~85% Of US Energy Demand Growth Coming From Renewables Through 2025.”

Craig,

” I DO have a problem with folks who present data that’s completely incorrect ”

Like most advocates for Solar power you confuse power generation with “usable” power. Generating uneconomic and unwanted power to meet the necessities of government subsidies or mandates, is not the same thing as generating consistent and adequate power to meet the needs of industrial societies on a planet wide basis.

Your understanding of “usable” power and grid compatibility is possibly a little naive. Utilities may not record the dumping of excess “renewable” power during a surge because they either receive a subsidy or is required by mandate, instead records the dumping of excess conventional power, thus maintaining the illusion of renewable percentages. (see testimony by TVA in support of ceasing to purchase home generated power.)

In each of the articles you referenced, the calculations were directed at meeting specific mandated “renewable” targets or in localized favorable conditions. An example is Denmark. On the surface, Wind power would appear to be a big success in Denmark, but Denmark doesn’t have an isolated national grid. The Danish grid is only a sub-grid to a much larger grid allowing Denmark to export surplus power to heavily subsidized, and much larger grids. Without these customers, Denmark’s wind power project would be completely uneconomic.

To be fair, Denmark benefits from it’s location and natural wind conditions to generate export income, so in this context Wind generation could be said to be a success.

Your implied claim that Solar and Wind generation can and will provide provide adequate power generation to economically replace and expand existing power generation on a world scale, is simply not tenable.

Just as the US Ethanol Industry spends hundreds of millions lobbying to stay in existence by virtue of government subsidies and mandates, so too does the solar-wind energy industry, although to a lessor extent.

The concept that Solar and Wind can replace existing generation because a few banks express interest and make enthusiastic statements over lunch, may not be the best or wisest investment advise ! ( actually very little bankers say over lunch should be taken seriously, bankers don’t have the best record when it come to brilliant investment advice after lunch :).

Banks will invest in anything that has solid government guarantees or support. Banks make a lot of money promoting investments where the risk can be can be packaged into easily managed structured investment instruments and the risk is passed onto investors while the profits are already retained by the bank. ( Yeildco’s are an example).

Solar and Wind technologies can give the illusion of power generation on an industrial scale, but trying to upscale becomes increasingly difficult as the generating capacity increases. ( The more renewable, the less economic the conventional contribution cancelling renewable savings).

I didn’t say Solar and Wind have no role to play. Obviously both have valuable (solar more so) applications in specialized circumstance. Nor did I say that Grid flexibility and compatibility won’t improve with better technology, but only marginally.

Back on the investment front, you may have noticed the recent market volatility in the solar industry as the bubble begins to deflate. Bankruptcies such as the Mark Group in the UK and others has shown how vulnerable these companies can be to fluctuations in government policies and subsidies.

In a recent Washington Times article, Drew Johnston argued of all the subsidies provided by the US government it’s least productive was for solar energy. The US investment of over $40 billion last year has resulted in an industry that provides only 0.6 of US power generation.

He went on to compare the Solar Boom to the US housing bubble of 2008 to 2010.

” U.S. Bankcorp, Bank of America and Merrill Lynch all established tax equity funds to help solar panel giant SolarCity exploit government tax credits and flood the United States with rooftop solar panels. Goldman Sachs followed suit with a $500 million fund to help Americans with poor credit purchase solar panels that they otherwise couldn’t afford – the same type of risky investment that caused the housing bubble to burst. ”

Now, I don’t agree with Drew Johnston completely, but his article is certainly well researched.

Daniel Verdú energy editor of El Pais commenting on the dramatic effect on the Spanish

Solar Industry caused by a reversal of government policy. Once doyen of the of the world solar industries, held up as an example of Grid integration and economic success, the Spanish government reduces the level of subsidies.

RREEF Infrastructure and Antin, two major funds linked to Deutsche Bank and BNP respectively, are taking Spain to the World Bank’s arbitration agency, the International Centre for Settlement of Investment Disputes (ICSID).

The Banks (including your friends at Credit Suisse) are complaining that Spain, by reducing the high level of subsidy to produce uneconomic power, has created losses for their investors.

This sort of unfortunate situation will always occur when technology investment is driven, not by economics and necessity, but by political idealism and over optimism.

” data that’s completely incorrect,” ? Hmmm… well that just depends on which “data” you chose to rely upon, doesn’t it ?

If you honestly study this subject, you will come to learn that I correct here. Actually, you don’t even have to study it; just look around you and watch what is happening.

Graig,

I do look around, but perhaps not with such rose tinted glasses. Think of the billions,..no Trillions of dollars,( and increasing damage to the environment ), that would have been saved if the US government had abandoned support and removed the mandate for US corn ethanol production. Think of the lives destroyed by the continuation of this futile policy.

Everyone, especially Presidents, find admitting error difficult, but the longer bad policies are pursued for ideological reasons, the more painful it becomes to seek an alternative.

Whilst I acknowledge that it would be hard for an electricity grid to operate entirely on solar and wind power, and require a considerable amount of energy storage, the percentage of demand which can be met from these sources is higher than many people might think.

Several factors can contribute to allowing a large percentage of intermittent generation.

1. The nature of the grid and the sources contributing to power supply

– for example, some African nations generate the majority of their electricity from hydro-electric dams, and may in any case fall far short of delivering as much power as the market is calling for. With such a starting point, large amounts of wind and solar generation can be added to the system without adverse effects provided the grid is strong enough to transmit the power generated – every watt generated from such sources either helps reduce the amount of deliberate power outages, or preserves water behind the dams for when the sun is not shining and the wind is not blowing.

– another example, Norway with a total hydro generating capacity of 29 GW acts as a giant buffer for wind and solar power across much of Northern Europe including Sweden, Denmark, Germany and the Netherlands to which its electricity grid is connected (Soon to be joined by the UK.) When the wind blows or the sun shines in these neighbouring countries, Norway modulates its hydro power generation using solar power from Germany or wind from Denmark in preference to its own hydro supply and earning higher rates by deferring hydro generation for when these sources are less available.

2. Geographical aggregation – with continent scale power grids such as that now emerging in Europe, excess solar or wind generation in one region will often coincide with still or cloudy conditions in others. Across such a large region, intermittent generation never reaches anywhere near 100% of rated capacity, is rarely close to 0% of nominal capacity and is far more predictable than for any smaller area. (Like tossing a coin – toss it once, the outcome is pure guess work, toss it 10 times, and you will likely get between 3 and 7 heads, toss it a million times, and the deviation from 50% becomes negligible).

3. Some loads are not time dependent – you can move water between supply reservoirs, generate liquid nitrogen, heat up a hot water tank, fine tune the temperatures in a frozen foods warehouse, or charge an electric vehicle with some degree of time flexibility so long as the required service is available when required.

4. New and cheaper energy storage technologies are emerging which will increasingly facilitate grid stability with a higher proportion of intermittent generation.

5. Energy efficiency is improving so that electricity demand in a number of developed markets has been reducing for several years. Whilst this does not in itself permit a higher percentage of intermittent generation, it reduces the overall investment required to achieve a given percentage of low carbon electricity.

Using these strategies, it is likely that around 50% wind and solar power generation can be achieved, with the rest made up of hydro, nuclear, geothermal, and a small proportion of generation from fast reacting natural gas turbines or fuel cells (Preferably operating in CHP mode.)

In conclusion 100% of generation from intermittent renewables – unlikely in the near term.

80% to 90% low carbon generation across much of the world from a combination of intermittent and other sources of low carbon electricity such as hydro, geothermal, and nuclear – a worthwhile and I believe achievable medium term goal.

Thanks. All perfectly true.

There are numerous others we can add, e.g., that the absence of wind at a certain place increases the probability of finding it at another.

Etc.

garyt1963

Thank you for your well reasoned comment. Rapidly advancing technology is certainly a friend to energy distribution.

In the future it will certainly be able to successfully integrate many different types of energy generation. But it will always remain a question of economics. The problem of distribution and flexible (base load) generation will always dominate economic generation.

Technologies which produce intermittent power are inherently incompatible with the needs of industrial societies. At best these technologies can provide energy for specialized purposes or contribute additional power when conditions are appropriate.

It becomes a question of economics. Obviously any method of power generation that can provide more economical base load power (power on demand) will become the major contributing technology. If the generating plants can also be located economically in major centres of demand thereby reducing distribution losses and associated costs, so much the better.

But spending vast sums of money, on ineffective and inherently inappropriate technologies, for purely ideological reasons is folly. It’s even greater folly to pretend that because you believe something should ideally be able to work, it can always be made to work.

MarcoPolo: This is a battle of scientific and economic principles on which you’re clearly behind. Better said, this is a battle that you have clearly lost.

I actually like you, & I sincerely thank you for having brought some good concepts our way. However, it’s clear that you have stepped beyond the boundaries of your competence in terms of science and economics in this case. I only ask you to read more.

Strangely, this is actually the same advice that I give myself all the time, that is, reminding myself of the fact that God gave us two ears and only one mouth, meaning that that He must have intended us for us to listen more, and speak less.

In actual fact, I’m not a religious guy, but I think there is a great deal of truth here. I try to read far more than I write. I recommend to you the same.

Curiously, I don’t see myself involved in any ” battle “, so I’ve never really considered the question of” winning” or ” losing “. These are terms important to advocates or ideologues, and I don’t think I fall into either category.

But maybe i am guilty or misinterpreting you, and I certainly have no wish to be so offensive so please correct me if I have misunderstood your position. If I understand you correctly, you contend :

1) Wind and Solar technology is becoming economically feasible to significantly replace fossil fuel for energy production on a global basis.

2) The problems of intermittent power absorption by national grids has been overcome.

3) Industrial societies can be economically powered by intermittent “power by supply” not “power on demand” and this will not affect the economics of base-load power generation.

4) The evidence your offer for the veracity of these contentions is

a) Discussions with banking executives over lunch

b) Articles based on press releases from Goldman Sachs, Credit Suisse, Deutsche Bank and Wells Fargo.

c) A Summary of a Thesis by Paul Reynolds 2008 of the Centre for Environmental Policy

Imperial College London

d) A hypothetical study of the Irish grid in 2020 if it adopts the EU requirements.

c) A 2011 article by Herman K. Trabish in Greentech Media.

I hope I haven’t misrepresented your references, if so, please correct me ?

For the purpose of a fair and frank exchange of viewpoints let me explain my contentions and since you feel I read insufficiently, my sources of reference. I hope in that way to have an amicable exchange of views.

1) Wind and Solar technology lacks the ability to replace fossil and nuclear generation on a global basis due to a lack of generating capacity, and an inherent problem with being able to overcome the need for an intermittent, e source to produce the economic “power on demand” , essential to industrialized societies.

2) Although better ESD and transmission programming and infrastructure will assist Wind and Solar, both will remain marginal and low percentage contributors to power generation in the foreseeable future.

3) The economic rationale for these industries is based on continuing massive government (taxpayer) subsidies and mandates. The ideological rationale is the erroneous belief that these technologies are the best method of preventing carbon emissions by power generation.

4) A significant percentage of Power generated by Wind and Solar is simply dumped by the grid due to the incompatibility of base-load power and intermittent power. All transmission systems and power grids are equipped to avoid “surges”. Power utilities “dump” excess power on a regular basis due to surges and wanes in demand. That’s the nature of power grid, ramping up and down, is costly and creates excessive wear on infrastructure. It’s a constant problem for utilities.

To support my contentions I have advanced the following references.

a) 2013 article published in the Energy Collective. by Willem Post titled ”Wind turbine energy capacity less than estimated”

b) 2013 Micheal Lind article in the Energy Collective, titled Germany and the Solar Energy Revolution.

c) Germany’s Green Energy Disaster: A Cautionary Tale For World Leaders By Howard Rich 2014 Forbes

d) Once ‘Overhyped and Sexy,’ Solar Tumbles Back to Earth by Javier E. David 2015, CNBC

f) Solar Energy Embarrassingly Less Productive than Coal Rudy Takala 2013 Daily Signal

g) Washington Times article, Drew Johnston 2015

h) Daniel Verdú energy editor of El Pais, 2015.

i) 2013 by John Hinderaker ” Is Europe Giving Up on “Green” Energy?” Times (of London).

j) Dan Stroud 2015.Washington Times ” Offshore wind enormously expensive energy alternative

k) 2013 The Economist ” Tilting at windmills Germany’s Energiewende bodes ill for the country’s European leadership ” ( From the print edition)

J) 2015 Matt McGrath Environment correspondent, BBC News “German tariffs make green energy too expensive to store ”

M) 2014 Forbes, Loren Steffy “Requiem For Spanish Wind? ”

N) 2013 Forbes , Larry Bell “Green Power Gridlock: Why Renewable Energy Is No Alternative”

o) 2013 Mary Kay Barton New York Times “New York Wind Wars: Hiding the Facts (PTC allows Invenergy to desecrate) ”

p) December 2, 2015 NPR Lauren Frayer ” Bankruptcy Looms For Spain’s Green Energy Giant ”

s) November 30, 2015 Mike Orcutt MIT Review ” Why Solar Power Could Hit a Ceiling-In the absence of energy storage, solar energy can’t grow without decreasing its own value “.

t) 2015 Forbes, Michael Lynch ” The Real Numbers On Energy Subsidies ”

u) 2015 Reuters, Kevin McCarthy “The American energy story Obama won’t tell the world ”

x) 2015 Bloomberg Jesper Starn and Weixin Zha “Germany Pays to Halt Danish Wind Power to Protect Own Output ”

y) 2014 Financial Times ” UK Energy Doldrums Kill Massive Wind Farm ”

z) 2015 Holman W. Jenkins, Jr.The Wall Street Journal “A Nuclear Paradigm Shift?”

Hmmm.. sorry about the length of the list, but this only represents 1% of articles, papers and books I have archived on this subject. I am surprised and a little hurt, that you would imagine I haven’t read just a little on the subjects about which I comment. I certainly have more regard for you than presume to comment without having first done just modest amount of research.

The article quoted have been selected from moderate respected sources.

Your banking friends are not being deceptive when they talk about investment, it’s just they don’t have they same perspective as you. They live in a very different world. There objective are not your objectives, as the Spanish example displays.

As an analyst I try to be very thorough, and carefully assess all points of view to compile as complete, and objective overall assessment as possible.

Of the references you quoted, I’m afraid I wasn’t very impressed by the 2008 Thesis by Paul Reynolds , who end with the phrase ”

” It is clear that the top priority for the Government must be to ensure that the ambitious targets for wind development must be met, at least

to 20% penetration, and not to worry too much about curtailment. Ultimately, curtailment can be managed, climate change cannot ”

( Not really objective scientific analysis , more in the nature of political advocacy)

My criticism of the graph you published, is it only represents an old hypothetical prediction of the future if certain conditions occur. It’s also predicated on government mandated action.

I liked the article in Greentech Media. Even though it was 5 years old, it was was well researched and supports both our contentions !

EG:-

” Utilities motivated to add wind to their portfolios, either because of state mandates or because they anticipate that such assets will accrue in value, now may find it necessary either to require developers to accept a certain level of unreimbursed curtailment or to commit to paying even if production is curtailed. Often, it is only by insulating developers from curtailment losses that utilities can meet planned or mandated goals.

“The utility has some mechanisms in the market to hedge congestion risk,” Moland said. But what the utility cannot hedge may, of course, be passed along to the ratepayer.

The best solution for eliminating curtailment, Moland speculated, would be cost-effective energy storage. But the three best candidates (pumped hydro, compressed air and battery storage) presently have challenges that limit their cost-effectiveness.”

Sorry for the length of the post, but I didn’t want you thinking i would be so discourteous as to not read a something before I commented !

Like I said originally, it depends on what you read ! I also could list several hundred articles, books, and papers i have read supporting your contentions, some very well argued.

However, on the balance I have come to the conclusion (and I could be wrong) that despite massive taxpayer subsidies, and mandates, Wind and Solar technology lack the essential feasibility to be economically upscaled to compete with the potential of advanced thorium reactors.

I also believe that there are far more practical, and less expensive methods of reducing carbon emissions, that would encourage the economic viability and spread of small scale solar.

My fear is that smaller, less glamorous technologies are being overlooked in the crusade for wasteful ideologically driven technologies, in the same manner as Ethanol is no proving impossible to terminate.

,

Anything you, I, or anyone needs to know about this subject is available at http://energyfactcheck.com/.

You can call it whatever you want, but to the extent that you’re promoting an idea that runs counter to these facts is, in fact, a battle, and one that (thank the Lord) you’re destined to lose.

Even the oil companies agree that, by 2060, the vast majority of the world’s energy will derive, in one form or another, from the sun. All any of us is doing is squabbling about the exact date, and the exact amount of long-term environmental damage that will have been done in the process.

As I just wrote:

To be clear, I’m aware that the fossil fuel industries will be here for a long time to come, and that’s actually a good thing, as I’ll explain below. I recommend adopting an energy policy that makes it very clear that the U.S., as the de facto world leader in terms of scientific and economic horsepower, is phasing out fossil fuels at the maximum rate feasible. To summarize:

NOW: Replacing coal in our grid mix with an array of solutions that include efficiency, wind, solar, storage, natural gas, and, as it can be accomplished cost-effectively, advanced nuclear.

NEXT 10 – 20 YEARS: Replacing oil as the fuel for cars and light-duty trucks with battery electric transportation.

AT SOME POINT IN THE FUTURE: Replacing the most difficult-to-address applications, i.e., cargo ships, Class 8 trucks, air travel.

I also suggest “The Third Industrial Revolution” by Jeremy Rifkin, which, I believe, is exactly what we’ll be seeing in the not-too-distant future.

Craig,

Um, ..I repeat, I’m not actually promoting anything, I have no platform or agenda, my comments are simply based on an analysis of the feasibility of your advocacy. It’s illuminating that you consider yourself on one side of a “battle”. In one way that’s to be admired, commitment to a righteous cause is admirable. However, it can tend limit tolerance, lose perspective and curtail objective analysis.

Now don’t get me wrong, I like ” energyfactcheck.com.” I even think it’s parent the American Council On Renewable Energy, does valuable work.

However, ACORE is by it’s own definition an ” organization dedicated to building a secure and prosperous America with clean, renewable energy “. It’s hardly an impartial font of all wisdom !

You’re kind of hard to pin down when it comes to specifics, you accuse me of not reading, so I say OK, here’s my sources and list a small percentage consisting of 26 current articles from highly respected publications, while politely pointing out the flaws and out of date content in the references you provided.

You may not have agreed with my references, but I am disappointed at your failure to acknowledge that your accusation “I had done no reading “, may have been in error, ? .. but nevermind. ( oh, and I’ve even read three of Rifkin’s rather egotistical books 🙂

I’ve also tried to explain that Investment bankers inhabit a different world, and a different mindset than the average person. Investment banks do not really make money from wise investments in sound companies and industries with proven products. Investment Banks make money from creating, packaging and trading in financial products. Profits are generated not from the long term success of the enterprise or industry, but from myriad fee’s, charges, derivatives, trading and speculation on the financial funding of the enterprise or industry. It involves hugely complex dynamics, and altogether understood, even by those who work inside the industry.

When government’s are involved by virtue of subsidies, mandates etc, it becomes a feeding frenzy, especially since no banker believes that he will be the last man standing when the music stops.

Curiously, from what you now declare to be your manifesto, we seem to have much common ground. I also believe that the world will transition away from fossil fuel energy production. So we seem to share a common objective.

The question is how ?

What you propose is a major, very disruptive “revolution” over a very short time scale which is where we fundamentally disagree. From my analysis your proposals are not logistically or economically ( or even politically ) possible within your time frame . Not even in the US, let alone the rest of the world.

The US is less reliant on Coal generation largely as a result of cheaper and more efficient natural gas production, not due to renewable energy.

I believe it’s easier, and cheaper in the long run, to replace existing power generation with a power source with compatible attributes. Thorium nuclear, especially the Japanese designed miniaturized plants, can replace traditional power without disruption. That’s a lot easier than trying to adapt an inherently incompatible technology.

When I say I don’t share your enthusiasm for a “revolution”, it’s not because I lack enthusiasm for a low-carbon, emission free environment, but rather I disagree with your rationale. I also doubt the value of ” huge idealistic symbolic national gestures”, in my experience they always end badly, while involving colossal wastage of public money.

Replacing the entire US automotive fleet in 10-20 years simply ain’t going to happen ! This is an area in which I possess some knowledge. I’m an early adopter, and ardent EV enthusiast, but it just won’t happen that fast. I should even declare a vested interest in the technology since I am a director and major share holder of an EV manufacturing enterprise. (Although according to your prophet Jeremy Rifkin H2 is the superior automotive technology of the future).

It’s fine to have a wish list, but confusing what you believe should happen, with what is possible to happen, lacks objectivity.

I believe there are many smaller, more practical ways to help the environment. Things that can be made to work, today.

For instance, if just a fraction of the $35 billion each year in US taxpayer subsidies for the Solar industry which generates less than 1% of power, or an even smaller fraction of the hundreds of millions wasted on the environmentally harmful Ethanol industry was diverted to support the introduction of EV Lawn mowers, small utility vehicles, and horticultural power tools, the saving in harmful emissions would be far more significant.

The US has 1-2 billion of these obnoxious little machines, each churning out the equivalent pollution of 100 cars when operating. ( Unlike cars, these machines have no pollution controls, and use more pollutant fuel).

Recent studies have shown that the pollution created by these machines approximates the pollution created by the entire US passenger fleet ! ( not to mention the hours of interrupted sleep on Saturday, Sunday mornings ! 🙂

Replacement of these product is easily achieved. The manufacturing facilities and technology exists, and is relatively economically viable without unacceptable disruption. In fact the electric versions perform better, and easier than fossil fueled versions. The cost of replacement is minimal, and would greatly assist the economic rationale for installing domestic Solar panels and home batteries (ESD).

The entire project would take a mere 5 years, with suitable government incentives, which could be funded in part from increased tax on 2 & 4 stroke fuel.

Maybe not the exciting “revolution” you are seeking, but a practical, feasible evolutionary process that requires little disruption, but introduces a widespread, popularization of low carbon, zero emission technology.

You’re right; I retract what I said about your “battle.”

This site is rife with details on all this; I’m reluctant to go through and summarize it all, especially when my most recent book (Bullish) says it all.

Here’s another post on the subject: http://2greenenergy.com/2015/12/04/renewable-energy-bullish/

Craig,

It would appear that one of the most charming energy utility CEO’s and a huge supporter of renewable energy has paid for his misjudgement of what investors expect with his scalp !

NRG Energy Inc’s CEO David Crane, a former investment banker who led NRG for 12 years, has been removed by his board and investors ( including Goldman Sachs ) for the reasons given in his statement to the WSJ :-

” investors made clear they would rather have had profits from the power-generation business returned to them through dividends and stock buybacks and not poured into clean-energy enterprises”

Like you, David Crane is a fine, decent man, an excellent executive and a visionary CEO.

Only two months ago he was full of praise for his boards support, ( including three major banks) .

Today he has learned the lesson between what banks say, and what they really think !