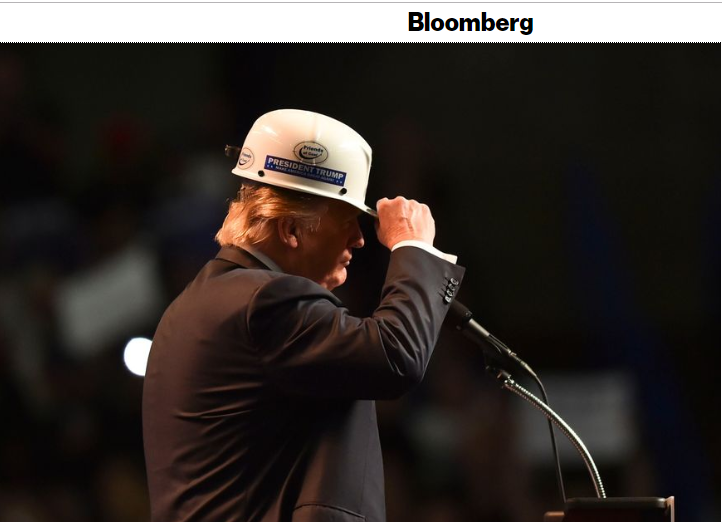

Bloomberg: “Biggest Private Coal Miner Goes Bust as Trump Rescue Fails”

FWIW, I don’t look at coal’s demise as a failing of the Trump administration; there is no power on Earth that could have saved coal, at least in the U.S., given its high cost structure and increasing competition from natural gas and renewable energy. The failing here is a moral and not an economic one. Integrity and ethics would have dictated supporting a rapid but carefully staged phasing out of coal in favor of nontoxic energy sources.

I hope readers will notify me if this administration gets anywhere within a parsec of integrity and ethics.

Craig,

For Robert Murry and many other Coal miners, Chapter 11 is simply a means of restructuring to shed debt.

The company hasn’t ceased operations, just the main operating company will dissolve while the operations and assets will be continued as Murray NewCo.

The restructuring agreement, backed by the lender group of creditors, provides for the appointment of Robert Murray’s nephew and former COO, Robert D. Moore, as the new president and CEO of Murray Energy.

Moore will be charged with the task of converting Murray energy into Murray NewCo in such a way as the workers’ rights and entitlements are safeguarded. assets, with Murray as chairman and Moore as CEO.

Murray NewCo will the assets, with Murray as chairman.

Murray Energy does credit President Trump for the increase in revenue in 2017 and 2018, but it wasn’t sufficient to maintain Murray Energy’s enormous debt accumulated during the Obama era.

It might be interesting to note, Michael R. Bloomberg, the founder and majority stakeholder of Bloomberg LP, the parent company of Bloomberg News, and sometime Democrat presidential candidate, committed $500 million to launch Beyond Carbon.

Beyond carbon, a campaign aimed at closing the remaining coal-powered plants in the U.S. by 2030 and slowing the construction of new gas plants.

Billionaire Bloomberg is also donor to the tune of hundreds of millions of dollars to democrat party funds, and was the Clinton’s 4th largest fundraiser.

While natural gas prices continue to remain low, demand for coal in the US will suffer. As the price of natural gas starts to rise, the coal industry’s fortunes will also rise.